New York Estate Tax Exemption 2025. Federal estate tax exemption to increase in 2025, but it is still set to fall back to $5m in 2026. When new york lawmakers approved congestion pricing in 2019, it was little more than a vague outline tucked into the state budget:

For people who pass away in 2025, the exemption amount is $13.61 million (up from the $12.92 million 2025 estate tax exemption amount). The assets may include real estate, cash, stocks, or other valuable.

The 2025 new york state estate tax exemption is $6,940,000 (up from $6,580,000 in 2025) and continues to be indexed for inflation.

New York Estate Tax • Ely J. Rosenzveig & Associates, P.C., The tentative and final roll. When new york lawmakers approved congestion pricing in 2019, it was little more than a vague outline tucked into the state budget:

How To Avoid The New York Estate Cliff Tax, As of january 1, 2025, the new york state estate tax exclusion amount increased from $6,580,000 to $6,940,000. For people who pass away in 2025, the exemption amount is $13.61 million (up from the $12.92 million 2025 estate tax exemption amount).

New York Estate Tax Exemption 2025, Early estate planning is recommended to avoid a diminished legacy due to the new york estate tax. The new york estate tax exemption for decedents dying in 2025 has increased to $6,940,000 (from $6,580,000).

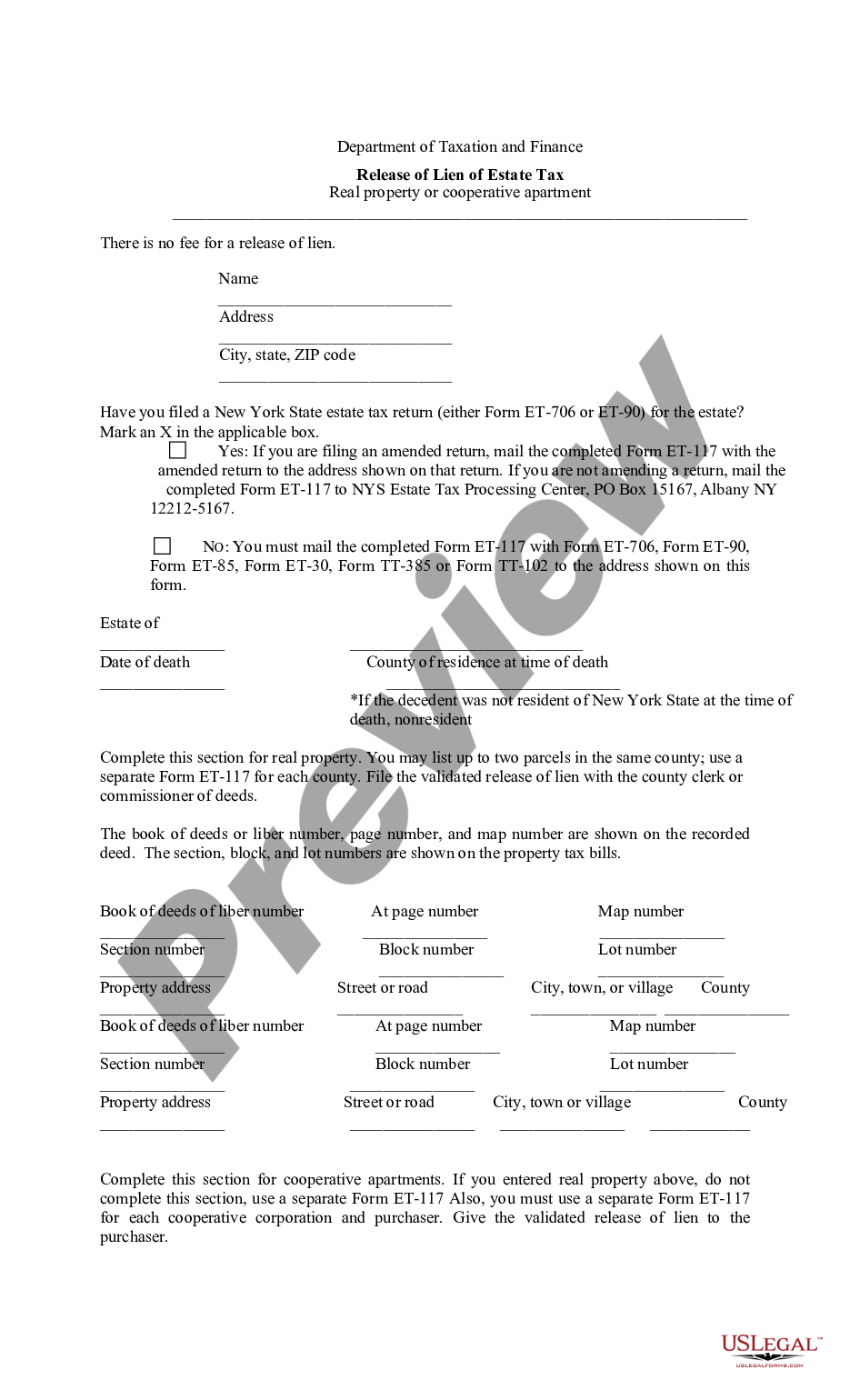

New York Estate Tax Liens and Form ET117, The irs and the new york state department of taxation recently announced the 2025 exemption and. Recently, the irs announced an increased federal estate tax exemption for 2025.

What Is The New York Estate Tax Exemption For 2025? [The Right Answer, The new york estate tax exemption equivalent is now $6.94 million and is phased out for new york taxable estates valued between 100% and 105% of the. Bess freedman says trump is too late.

New York Estate Tax Withholding For Remote Employees US Legal Forms, As of january 1, 2025, the new york estate tax exclusion amount increased to $6.94 million. It is indexed for inflation with 2010 as the base year for this.

![How Much Is New York Estate Tax? [The Right Answer] 2025 TraveliZta](https://www.travelizta.com/wp-content/uploads/2022/09/how-much-is-new-york-estate-tax.jpg)

How Much Is New York Estate Tax? [The Right Answer] 2025 TraveliZta, New york has state inheritance taxes that differ from federal estate taxes. We posted the basic exclusion amount for dates of death on or after january 1, 2025, through december 31, 2025.

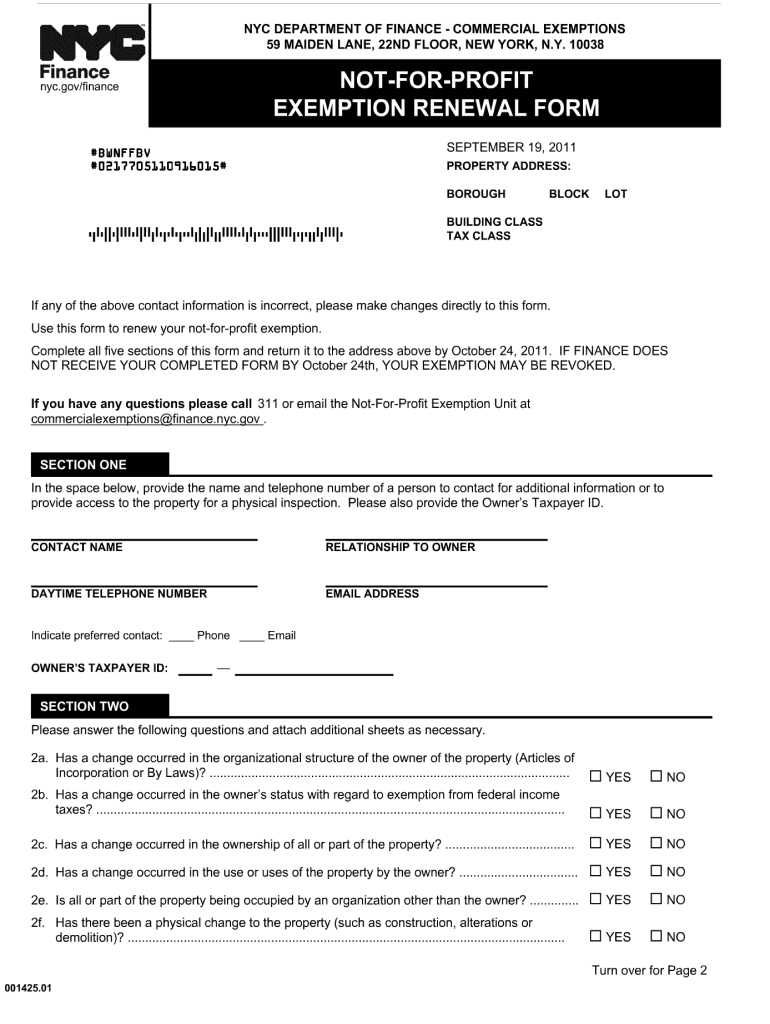

Nyc Property Tax Exemption Renewal Fill Online, Printable, Fillable, As of january 1, 2025, the new york estate tax exclusion amount increased to $6.94 million. New york state does not have a gift tax, but gifts made within three years of death are brought back into a donor’s estate for new york state estate tax purposes.

New York Estate & Tax Planning Wealth and Law, The information on this page is for the estates of individuals with dates of death on or after april 1, 2014. The state has set a $6.94 million estate tax exemption for 2025 (up from $6.58 million in 2025), meaning if the decedent’s estate exceeds that amount, the estate.

New York Estate Tax Win Opens Floodgates For Millions In Refunds And, The irs and the new york state department of taxation recently announced the 2025 exemption and. The new york estate tax exemption equivalent is now $6.94 million and is phased out for new york taxable estates valued between 100% and 105% of the.

The new york estate tax exemption for decedents dying in 2025 has increased to $6,940,000 (from $6,580,000).